What is changing?

One of the consequences mandated by the Financial Stability Board (FSB) in 2014 following the financial crisis was to initiate the replacement of benchmark interest rates such as London Interbank Offered Rate (LIBOR) and other interbank offered rates (‘IBORs’) by robust and reliable alternative replacement rates, a process hereinafter referred to as “IBOR Reform”. Consequently, some interest rate benchmarks changed their calculation methedologies or benchmarks, such as LIBOR, were phased out or will end in the future.

This page focuses on the implications of the IBOR reform.

-

IBORs were designed to reflect the price of interbank funding markets. Each IBOR was typically published daily, across a variety of currencies and tenors (e.g. overnight, oneweek, three-month, six-month), and were predominantly based on submissions by a panel of banks.

Changes in interbank funding markets and financial distress situations have proved that IBOR panel bank submissions became less focused upon observable transactions and more based upon expert judgment. In July 2017, the UK Financial Conduct Authority (FCA), announced that by the end of 2021 the FCA would no longer compel panel banks to submit quotes for LIBOR.

Cessation of LIBOR benchmarks

Given that LIBOR was widely used in various products and the volume of transactions referencing LIBOR was large, the discontinuation had a significant impact on both existing and future transactions, particularly in loans, bonds and derivatives.

On March 5, 2021 the Financial Conduct Authority (FCA) formally announced the dates of the future cessation or loss of representativeness of all 35 LIBOR settings currently published by ICE Benchmark Administration Limited (IBA).

The cessation of LIBOR settings is fragmented. All GBP, EUR, CHF, JPY, and some lesser-used USD LIBOR tenors (1W and 2M), ceased publication after 31 December 2021. The remaining USD LIBOR tenors will cease publication after 30 June 2023. Some GBP, JPY, and USD tenors will be non-representative after their respective cessation dates, allowing the FCA to potentially extend publication of these rates on a “synthetic” basis for use in “tough legacy” contracts only.

Risk Free Rates, new alternative replacement rates for LIBOR

-

A RFR, is calculated as a weighted average of executed traded volume in an overnight market. RFRs can be used as a benchmark to determine interest rates and payment obligations on numerous complex financial products from 2022, such as derivatives, bonds, loans, structured products and mortgages.

Regulatory Sponsored Working Groups were set up to select alternative RFRs across all major currencies.

The Bank of England’s Working Group on Sterling Risk-Free Reference Rates (the “RFR Working Group”) recommended using the Sterling Overnight Indexed Average rate SONIA. It has been published since 1997 but was reformed in 2018.

In the US, the Alternative Reference Rate Committee (ARRC) recommended the Secured Overnight Financing Rate (SOFR), a rate that is based upon the O/N US Treasuries Repo levels. SOFR has been published since 2018.

The National Working Group on Swiss Franc reference rates (NWG) was the key forum for considering proposals to reform reference interest rates in Switzerland. The NWG recommended Swiss Average rate Overnight (SARON) to replace CHF LIBOR. SARON references actual market transactions in the Swiss franc interbank repo market (i.e. secured). It has been published since 2009.

The Cross Industry Committee on Japanese Yen Interest Rate benchmarks selected the Tokyo Overnight Average Rate (TONAR) / (TONA), which is an uncollateralized overnight call rate. It has been published since 2016.

The Working Group On Risk Free Rates in the Euro Area recommended the Euro Short Term Rate (€STR) as the replacement for the EONIA overnight rate. €STR reflects wholesale Euro unsecured overnight borrowing costs of Euro area banks and has been published since 2nd October 2019. Further details in €STR and EURIBOR benchmark will be provided under EURIBOR section below. -

RFRs are described as ‘risk-free’ and are derived from actual transactions that have taken place in the liquid underlying markets.

There are some fundamental differences between LIBOR/IBORs and RFRs, including:

Calculation direction - RFRs are backward looking overnight rates whereas LIBOR/IBORs were forward looking term rates. This means that for LIBOR the interest rate was fixed and publicly available at the beginning of each interest period. By contrast, the total interest accruing over a period based on a compounded RFR cannot be determined until the end of that period. A new lookback mechanism ensures that the parties know the interest that will be payable at the end of that interest period a few days in advance of the payment date. Therefore, we would recommend getting familiar with the new market conventions and calculation methodologies.

Credit and Liquidity Premiums – LIBOR/IBORs fixings include the cost of bank credit risk and term liquidity risk as they are calculated based on the submissions of panel banks at which rate they can borrow unsecured funds in the relevant interbank market, whereas RFRs are based on overnight transactions and do not have term structure. Transitioning existing contracts from LIBOR to RFRs may involve process incorporating a spread into RFR to cover the lender’s funding costs, etc.

-

The credit spread adjustment was developed to minimize the economic impact on a contract when its reference rate was switched from LIBOR to the applicable RFR, as LIBOR was a rate that included a term credit risk spread component. There are a number of situations where the CAS was applied, for example: the ISDA fallbacks for derivatives; or in fallbacks for cash products. A credit adjustment spread was calculated for each currency and tenor.

-

The derivative and loan markets moved towards consensus in applying the historical 5 year median methodology for CAS for fallbacks. In the derivative markets, the ISDA published an IBOR Fallbacks Protocol and Supplement to the 2006 ISDA Definitions. This protocol allowed market participants to incorporate the revised fallbacks into their legacy non-cleared derivatives trades with other counterparties that also chose to adhere to the protocol. Bloomberg published these rates.

In the loan market, the amendment process of deals is manual. Each loan contract was reviewed and amended by the parties before the final cessation of LIBOR fixings.

Alternative CAS approaches were used, with a forward looking approach used for cash products. This technique used RFR / LIBOR basis swap pricing to provide a CAS level. -

Market participants called for the development of forward looking term rates derived from RFRs (term RFRs) at an early stage in the transition process. Term RFRs make it possible to calculate the interest payable over an interest period at the beginning of that interest period.

The UK regulators made it clear that a Term SONIA was being made available for certain financial assets and specific customer groups:- Small and medium size businesses

- Trade Finance and Working Capital products

- Export Finance

The US regulators have chosen a different approach. On 29 July 2021, the US Alternative Reference Rates Committee (ARRC) announced that it formally recommended the forward Term SOFR published by CME Group, Inc. (CME) for use in connection with business loans.

This announcement is significant for syndicated loans denominated in US Dollars for two principal reasons. First, the ARCC's recommendation of a Term SOFR is the first step in the waterfall in the ARRC's recommended LIBOR fallback language for loans and for many other financial products under the US law. Consequently, when a trigger event occurs, Term SOFR would become the LIBOR replacement in many loan agreements after June 30, 2023.

Secondly, Term SOFR is now seen as a practical alternative for bilateral deals when compared with the backward–looking RFRs.

However, Term SOFR is not generally recommended for use in derivatives, with limited exceptions (including a hedge of a SOFR loan or other cash product). The limited use cases for Term SOFR reflect a concern that trading in Term SOFR may detract from liquidity in overnight SOFR, which would render that rate less robust.

If you are interested to find out more about Term SOFR use cases, please contact your loans and derivatives specialists in the relationship banks.

In Japan, there are several candidates for alternative benchmarks to replace LIBOR. One of them is Tokyo Term Risk Free Rate (TORF) calculated and published by QUICK. However, the use of compounded TONA in arrears currently prevails for alignment purposes in the multicurrency business loan agreements.

The National Working Group on Swiss Franc Reference Rates is not intending to develop a term rate for SARON.

The Working Group on Euro Risk Free rates has not released a target date for when it expects to publish a term rate.

Developments in other currencies

-

On July 2, 2019 the European Money Market Institute (EMMI), the administrator of EURIBOR, was granted the authorisation by the Belgian Financial Services and Markets Authority (FSMA) the right to administrate EURIBOR under Article 34 of the EU Benchmarks Regulation. This means that EURIBOR was transitioned from a quote –based EURIBOR methodology to the new hybrid methodology. The transition was seamless and did not require any specific amendments of the existing contracts.

For more detailed information, please follow the link below:

EMMI - European Money Markets Institute | REFORM (emmi-benchmarks.eu) -

On October 2, 2019, the new EURO short-term rate (€STR) was published for the first time by the European Central Bank (ECB). On the same date, EONIA stopped as an independent fixing. Instead, EONIA was calculated based upon an €STR plus a fixed spread of 8.5 basis points (bp.)

-

CIBOR is not a critical benchmark. The Danish Financial Benchmark Facility (DFBF) has not shared any plans nor intentions for discontinuation of this benchmark. Therefore Danske Bank A/S continues using CIBOR without any changes.

However, as central banks in other countries are reviewing the alternative rates to IBORs, the National Bank of Denmark has accepted to become the administrator of the new Danish reference rate, DESTR, scheduled to be launched from April 2022. For more information, please follow the link below:

Transaction-based reference rate (nationalbanken.dk)

-

STIBOR is a critical benchmark and on March 1, 2021 the Swedish Financial Benchmark Facility (SFBF) has published a public consultation on the Evolution of STIBOR that presents a comprehensive review of the definition of STIBOR and the calculation methodology, together with proposed adjustments to increase the robustness of the benchmark. Danske Bank A/S is following the developments and if you have any questions on your contracts, please contact your usual relationship contact. More information about the consultation is provided in the link below:

Public Consultation - Swedish Financial Benchmark Facility (swfbf.se)

On January 27, 2021 the Riksbank started the testing of the Swedish Krona Short Term Rate (SWESTR), a rate that is a transaction based reference rate calculated based on the basis of transactions executed on the money market from one banking day to the next in Swedish kronor. On September 2, 2021 the publication of SWESTR has been officially started.

For more information, follow the link below:

SWESTR | Sveriges Riksbank -

Norske Finansielle Referanser (NoRe) is from January 1, 2017 the administrator for NIBOR. NIBOR is not a critical benchmark and therefore Danske Bank A/S continues using this benchmark in the financial contracts.

In early 2018 a working group on alternative Norwegian krone reference rates was established by the Norges Bank. On January 1, 2020 the Norges Bank took over the role of an administrator of Norwegian Overnight Weighted Average (NOWA) daily rate. The working group on alternative reference rates has focused on two working directions:- Market standards and fallback solutions for NOWA

- Establishment of an OIS market in NOK using NOWA

Multiple consultations on NOWA were published by the working group of Norges Bank in 2020. The Norwegian market is the most advanced in its progress on an alternative daily rate application among the Scandinavian countries. For more information, please follow the link below:

Documents from the working groups on alternative reference rate (norges-bank.no) -

In Asia, most of the jurisdictions plan to adopt a multiple-rate approach for their respective local benchmark reforms, with enhanced benchmarks expected to remain alongside alternative RFRs. For example: for HKD contracts, enhanced HIBOR is expected to continue alongside HONIA.

On 12 November 2020, the administrator for CDOR issued a public statement that it will cease to provide the 6-month and 12-month CDOR tenors from 17 May 2021 onwards and that the last day of publication for these tenors will be 14 May 2021. It means that the market participants may continue using the most popular 1-month and 3-month CDOR tenors without any interruption.

6-month and 12-month CDOR tenors have an option to switch to CORRA after the cessation date.

For more details on each specific currency, please contact your usual relationship contact.

What does it mean for me as a Danske Bank customer?

-

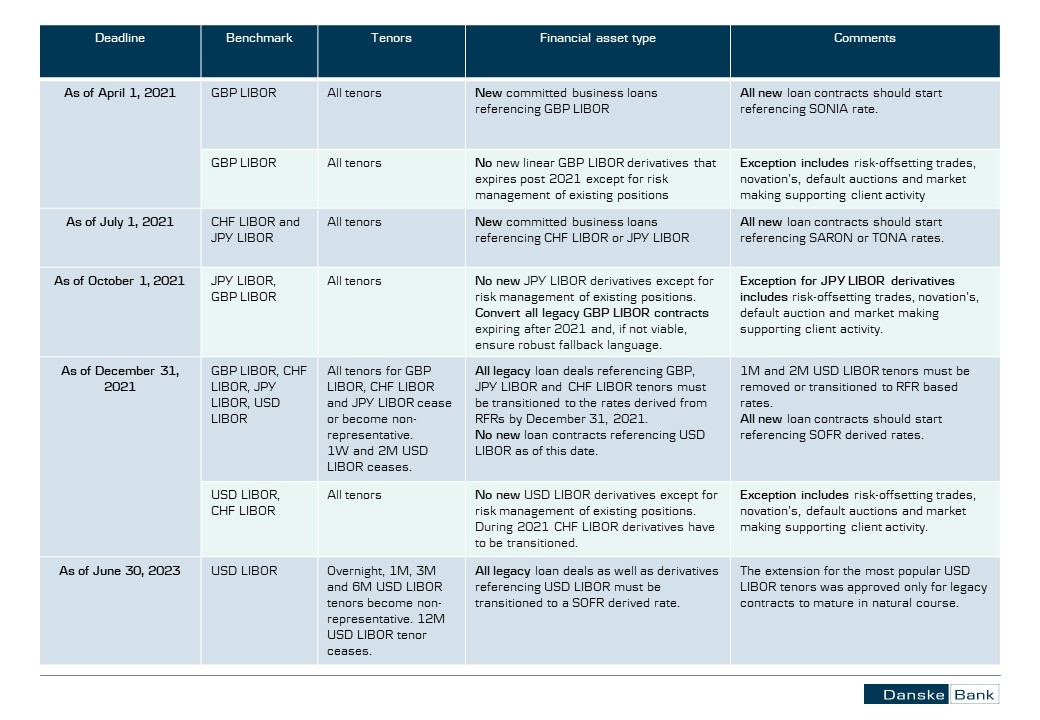

Download the transistion deadlines table here

-

Taking into consideration that the USD LIBOR cessation date is rapidly approaching and regulatory authorities strongly encourage market participants to seek to significantly reduce their USD LIBOR exposures sufficiently in advance of the end of June 2023, we would like to invite you to consider the following option:

An amendment of your current committed business loan agreement to include a pre-agreed conversion mechanism (a so-called “Rate Switch” mechanism). The Rate Switch mechanism facilitates the change from an USD LIBOR to a compounded RFR SOFR (or daily simple average RFR and/or other alternative benchmark derived from RFR, where applicable).

The amendment of your credit agreement to include a Rate Switch mechanism will incorporate the mechanics and provisions necessary for automatic transition to the selected RFR based rate, thereby mitigating the risk in 2023 (depending on the currency and jurisdiction), when LIBOR is declared to be non-representative.

You should expect that the amendment process would take some time in order to reach the agreement on multiple currencies and lenders. Therefore, we encourage you to contact us at your earliest convenience and start discussing the transition strategy now.

In any event, we recommend that you familiarise yourself with RFRs and consider transacting to RFR referenced loans in your new deals as well. Please feel free to reach out to our loan professionals with any questions you may have in relation to USD LIBOR transition, new conventions for use of RFRs in relation to loans or the transition/amendment process. We will do our best to answer your queries.

You can find more information about IBOR reform in our FAQs and the webinar at the section "Danske Bank's webinars and FAQ's". -

When transitioning your IBOR derivatives to the RFR rates be aware of whether these are linked to loans or other instruments that have an IBOR reference. If your derivatives are linked somehow, it is recommended that you aim for similar conventions for the derivative and the linked instrument. By failing to do so there is a risk of a mismatch in terms of economics and accounting.

We recommend that you get an overview of the fallback rates in your derivatives contracts and consult with your external advisors on what actions are needed. Please be aware that it is possible to adhere to the ISDA 2020 IBOR protocol if you have an ISDA Master Agreement. By adhering to the protocol the fallback language in your legacy derivatives will be amended with ISDA’s fallback rates. Whether this is suitable or not depends on the nature of your derivatives as well as their potential link to bonds and/or loans. You will need to consult your external advisors on this matter, and you can find more information and adhere to the protocol by following this link: www.isda.org/protocol/isda-2020-ibor-fallbacks-protocol/.

If you adhere to the protocol please be aware that it should not be seen as the final step in your transition. Regulators have frequently stated that the fallback rates should not be used as a mean of transition away from IBOR derivatives to RFR derivatives. Thus, we recommend that you restructure your IBOR derivatives into RFR derivatives prior to the cessation of the relevant IBORs. Not only will it be in accordance with the regulators guidance and intention. It will also mitigate your operational risk by ensuring that your IT infrastructure can cope with the new RFR rates, their compounding etc.

Finally, note that if your derivatives are cleared on LCH (London Clearing House) the transition is planned to happen automatically for USD LIBOR contracts prior to 30th of June 2023. -

Identification of USD LIBOR-linked contracts

As a first step, you need to identify where your USD LIBOR exposures are. You also need to examine whether the contracts mature beyond the end of June 2023. It is important to note that LIBOR may be used not only in loans, bonds and derivatives, but also other areas such as intra-group accounts.

Review your contract terms and conditions

Some of your contracts may not include fallback language related to permanent USD LIBOR discontinuation. You need to review and amend terms and conditions as necessary.

Operational readiness

You may need to update systems and infrastructure for the changes. Especially, the backward looking RFRs will require new IT development and the resources shall be attributed to this task with no further delay.

Communication with your relationship banks

You should communicate with your relationship banks regarding preparation to IBOR’s transition and impacts on your businesses.You may also want to engage independent consultants for advice, in particularly reviewing your exposures, potential impact for accounting and taxes, treasury management systems and processes that LIBOR discontinuation may have on you and your business.

Danske bank’s webinars and FAQs

More information on the IBOR reform

-

The FCA’s microsite on LIBOR transition:

Transition from LIBOR | FCA -

The goal of Alternative Reference Rates Committee (ARRC) is to ensure a successful transition from U.S. dollar (USD) LIBOR to a more robust reference rate, its recommended alternative, the Secured Overnight Financing Rate (SOFR):

Alternative Reference Rates Committee (newyorkfed.org) -

A working group of market participants formed to facilitate the transition from the interest rate benchmark LIBOR towards SONIA in sterling markets.

Working Group on Sterling Risk-Free Reference Rates | Bank of England -

The purpose of the NWG is to catalyze the transition to SARON and discuss the latest international developments in other markets on alternative replacement rates:

Swiss National Bank (SNB)

-

The aim of The Cross Industry Committee on Japanese Yen Interest Rate benchmarks is to ensure that the market participants properly choose and use Japanese Yen interest rate benchmarks

Cross-Industry Committee on Japanese Yen Interest Rate Benchmarks : 日本銀行 Bank of Japan (boj.or.jp)

-

The Loan Market Association aims to create a high-level framework of market standards and guidelines, providing a consistent methodology for use across the loan market. The LMA is actively involved in the LIBOR transition and seeks to align the documentation templates and guidelines for the lenders and borrowers.

Loan Market Association - the authoritative voice of the European market (lma.eu.com) -

The LSTA has been advocating for the U.S. syndicated loan market since 1995. As the LMA, they are fostering the cooperation and coordination among all loan market participants:

The LSTA - LSTA

Disclaimer

Please be advised that this page contains general information. It does not contain recommendations of any kind. You can always contact your regular contact person in Danske Bank if you wish to receive individual information about the IBOR Reform and how it impacts you.