- 1.0 What does ISO 20022 mean in Danske Bank?

- 1.1 Why ISO 20022?

- 1.2 When will ISO 20022 be implemented?

- 1.3 Who will be impacted?

- 2.0 What is CBPR+?

- 2.1 How will CBPR+ migrate to ISO 20022?

- 2.2 What messages are in scope for CBPR+?

- 2.3 How will Danske Bank navigate the migration to ISO for CBPR+?

- 2.4 Will Danske Bank continue to send MT messages, or will you move to MX?

- 2.5 Will MX messages be truncated during the coexistence period?

- 3.0 What does the ISO 20022-migration mean for corporates?

-

1.0 What does ISO 20022 mean in Danske Bank?

Migration to ISO 20022 is taking place globally with the aim to achieve greater harmonisation and standardisation in payments worldwide. Many local and regional market infrastructures, like TARGET services for EUR and CHAPS for GBP, along with the global standard for cross-border payments in all currencies via the Swift network (CBPR+) are changing their messaging standard from the current MT format to the ISO 20022 MX format.

For Danske Bank, the ISO 20022 migration means that we have to upgrade our systems and processes to be able to handle the new format and continue to offer payment services in the currencies and markets that we operate in. -

1.1 Why ISO 20022?

The potential benefits of ISO 20022 are many, but the headline of them all could be richer and more structured data. The ISO 20022 standard can hold much more information about the payment than we know from the current MT format, while at the same time providing a far more granular structure of the data. This allows for improved reconciliation processes and a higher degree of automation throughout the payments ecosystem, which offers opportunities for using the improved data for insights and analytics. -

1.2 When will ISO 20022 be implemented?

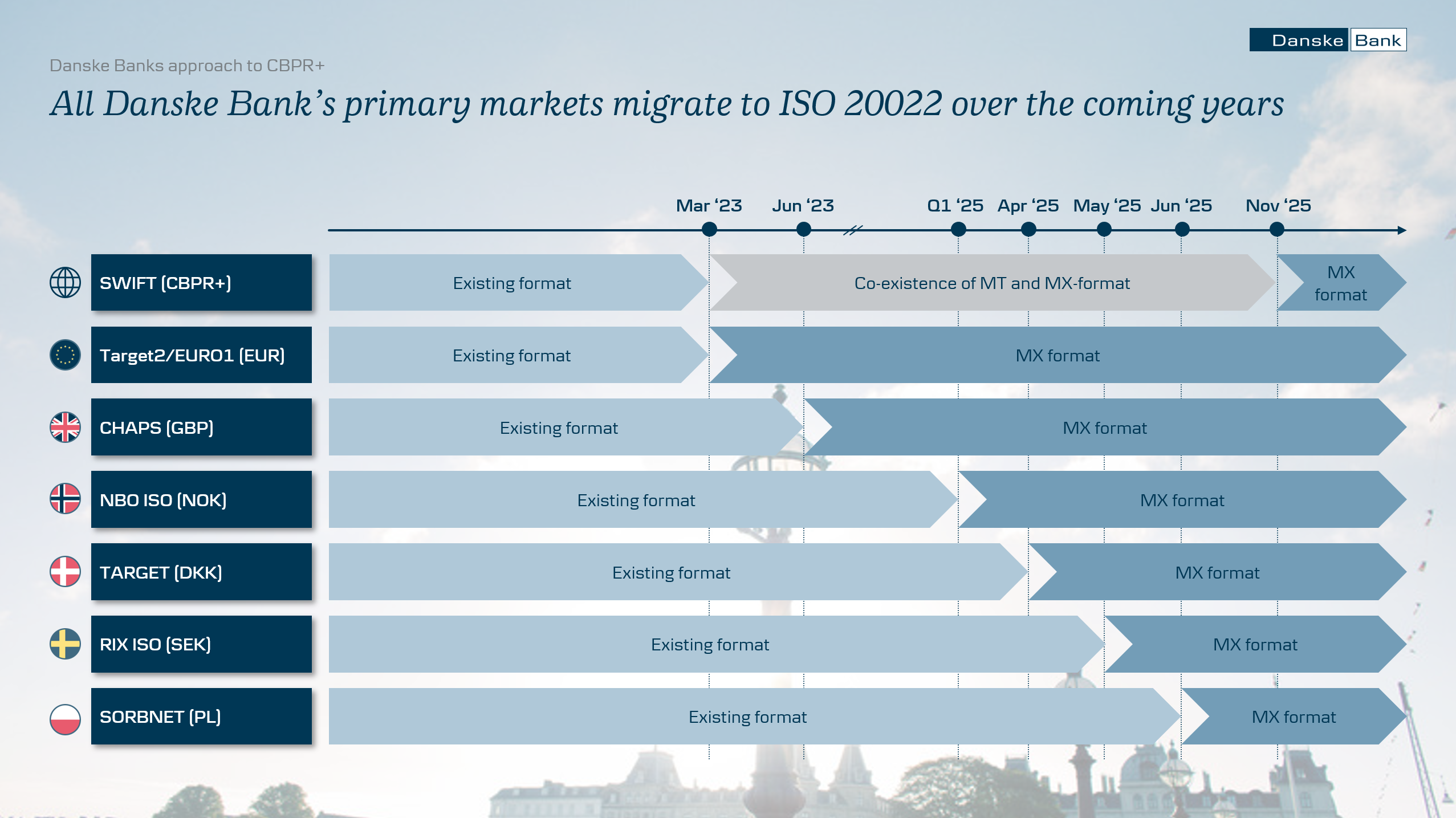

The industry is moving to ISO 20022 gradually; some market infrastructures went live in March 2023 and others will follow in 2025 and beyond. The below figure shows a high-level view of the most important deadlines from a Danske Bank perspective.

Market infrastructure timelines

In Danske Bank, we follow the deadlines set by the market infrastructures and will migrate accordingly, so we will send/receive payments in the ISO 20022 format when required. This means that our transition will take place gradually, similar to elsewhere in the financial industry. -

1.3 Who will be impacted?

Every financial institution that currently sends/receives FIN MT-formatted payments will be impacted, either by Swift’s CBPR+ migration or by local market infrastructures. Consequently, customers can expect changes to the data they can send and receive over time. For more information on the ISO 20022–migration's impact on corporates, please see section 3.0.

CBPR+ encompasses cross-border payments and correspondent banking activities covering all currencies, whereas the local market infrastructures relate to a single currency only (e.g., EUR).

-

2.0 What is CBPR+?

CBPR+ (Cross-Border Payments and Reporting Plus) is Swift’s ISO 20022 programme for adopting ISO20022 for cross-border payments and reporting messages in the correspondent banking space.

CBPR+ usage guidelines define how ISO 20022 messages are to be used for cross-border payments and cash reporting on the Swift network.

To understand how to translate the current MT message types into the new ISO 20022 format, please see Swift’s MyStandards. Here you will find translation overviews, information about SWIFT’s in-flow translation service and Transaction Manager Platform (TMP), as well as a wealth of other important materials, such as connectivity guidelines, a user handbook, customer adoption guides and customer testing guidelines.

For more information about CBPR+, please visit swift.com.

-

2.1 How will CBPR+ migrate to ISO 20022?

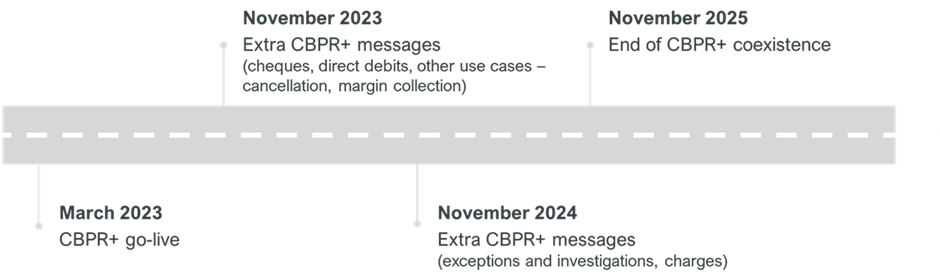

The use of ISO 20022 messages in the Swift cross-border payments space started in March 2023 with a coexistence period ending in November 2025, where the current MT messages for cross-border payments and cash reporting will be fully replaced by the ISO 20022 equivalents (MX). The implementation in March 2023 covered a series of payment initiation (pain), payment clearing and settlement (pacs) and cash management (camt) messages.

In November 2023, additional messages were implemented covering cheques, direct debits and a few other use cases (cancellation and margin collection). Additional CBPR+ messages will be made available in MX during November 2024, covering the new Charges messages (camt.105 and camt.106), and the new Exceptions and Investigations (E&I) messages (camt.110 and camt.111).

It is up to each correspondent bank to plan their own migration of the various message types between March 2023 and November 2025.

Source: CBPR+ roadmap | Swift

-

2.2 What messages are in scope for CBPR+?

March 2023Message types Existing FIN MT ISO 20022-equivalent Request for transfer MT101 relay pain.001 Multiple customer credit transfer MT102 pacs.008 Single customer credit transfer MT103 pacs.008 Single customer credit transfer (Return) MT 103 RETN pacs.004 Request for cancellation MT192 camt.056 Answer MT196 camt.029

(ONLY as a response to camt.056)Financial Institution Transfer for its Own Account MT200 pacs.009 Multiple Financial Institution Transfer for its Own Account MT201 pacs.009 General Financial Institution Transfer MT202 (COV) pacs.009 General Financial Institution Transfer (Return) MT202 RETN pacs.004 Multiple General Financial Institution Transfer MT203 pacs.009 Financial Markets Direct Debit Message MT204 pacs.010 Financial Institution Transfer Execution MT205 pacs.009 Notice to Receive MT210 camt.057 Request for Cancellation MT292 camt.056 Answers MT296 camt.029

(ONLY as a response to camt.056)Confirmation of Debit MT900 camt.054 Confirmation of credit MT910 camt.054 Request Message MT920 camt.060 Rate Change Advice MT935 camt.053 Customer statement message MT940 camt.053 Balance report MT941 camt.052 Interim transaction report MT942 camt.052 Statement message MT950 camt.053 November 2023

Message types Existing FIN MT ISO 20022-equivalent Customer direct debit initiation MT104 pain.008 Debit of debtors account MT107 pacs.003 Issuance of cheque MT110 camt.110 Stop payment of cheque MT111 camt.111 Advise of actions to stop payment of cheque MT112 camt.112 FI Direct Debit MT204 pacs.010 FI Cancellation request MT292 camt.058 November 2024

Message types Existing FIN MT ISO 20022-equivalent Charges MT190 camt.105 Charges MT191 camt.106 Query MT195 camt.110 Investigation request MT199

camt.110 Response MT196 camt.111 Investigation response MT199 camt.111 Charges MT290 camt.105 Charges MT291

camt.106 Query MT295 camt.110 Investigation request MT299 camt.110 Response MT296 camt.111 Investigation Response MT299 camt.111

MT 199/ MT 299 and MT 999 (used in payments business domain) will also be decommissioned in November 2025. Existing traffic will need to be migrated to the appropriate ISO 20022 equivalent.Source: https://www2.swift.com/mystandards/res/cbpr/CBPR_plus_MT_MX_equivalence_1Q2023.pdf (Swift MyStandards login required)

-

2.3 How will Danske Bank navigate the migration to ISO for CBPR+?

Danske Bank has chosen to take a phased approach to implementation, as we operate in markets that have different timelines for ISO adoption. We therefore need to be able to send/receive both MT and MX messages during the migration period, depending on the market infrastructures timelines. To provide further flexibility within Danske Bank, we are planning for an asynchronous migration, allowing the different domains within the bank to migrate at their own pace. This approach means that our outgoing traffic in MX will gradually increase as more and more product systems migrate. However, there will be made no distinction between currencies or different group entities/BICs, as each product system will be fully ISO native once they have been migrated.

We are continuously analysing when to migrate from the various MT message types to their MX equivalents to ensure an optimal offering to our customers and partner banks, while balancing the resources required to do the development. We will continue to update this site with information and details about our plans as they develop. Please find the latest version of Danske Bank’s roadmap below.

*Danske Bank is not sending MT200 & MT201.

-

2.4 Will Danske Bank continue to send MT messages, or will you move to MX?

While Danske Bank will continue to send messages in the MT format for now (unless MX is required by the relevant market infrastructure), we will be able to receive certain MX messages and process it as such. This means that we will process, screen and monitor the payment based on the original MX message in our product, AML and fraud systems, which will all be optimised for enhanced ISO 20022 messages.

As of November 2023, Danske bank can receive the following MX-messages under CBPR+: pacs.004, pacs.008, pacs.009, camt.029 camt.056, camt.057 and camt.109. -

2.5 Will MX messages be truncated during the coexistence period?

Since March 2023 when the MX format was introduced on Swift, there has been a risk of truncation, if the previous agent in the chain (e.g., the initiating bank) has sent an enriched MX message that exceeds the limitations of a regular MT message. All truncated messages will be clearly marked according to Swift’s standards so the truncated data can be delivered on request.

As many other financial institutions, Danske Bank is relying on Swift’s Transaction Manager Platform (TMP) to offer smooth and automated resolution to truncation in the coexistence period. -

3.0 What does the ISO 20022-migration mean for corporates?

Danske Bank already communicates with our corporate customers through ISO 20022 XML in many markets, and we will continue doing so. The utilisation of ISO 20022 in the customer-to-bank/bank-to-customer space already now provides our customers with the benefits of the richer and more structured data for certain payment flows and products.

Nonetheless, over time, ISO 20022 will be fully implemented in the interbank space as well, which means that certain data elements of the new format will be made mandatory (e.g. for anti-fraud or AML purposes). This will ultimately lead to ISO 20022 becoming the primary format to be adopted by corporates as well.

However, acknowledging that a migration of this magnitude might require a great deal of effort from some of our corporate customers, Danske Bank is continuously working on smarter solutions to make our customers’ migration to ISO 20022 as smooth as possible. For instance, we are currently working on an internal conversion service from the CBPR+ mandated camt.053 version 8 to any of the statements formats we currently offer to our corporate customers (e.g. MT940 or camt.053 version 2). We do this to support our customers’ transition towards MX statements, making sure it can be properly planned, so all the benefits of ISO 20022 can be extracted.

Some of the main benefits of a fully ISO 20022-ready ecosystem for corporates are:

Operational efficiencies: Richer and more structured data in the end-to-end process allows for increased automation of treasury, cash management and reconciliation processes.

Improved analytics: Improved and more granular data hold the potential to accelerate customer behaviour analytics with a view to improving services and products.

Safer payments: Reduced risks of fraud and exposure to risks of participating in money laundering as a result of improved sender/receiver data, purpose of payment etc.