We support our clients with green, social and sustainability bonds, green loans and sustainability-linked loans

Green, social and sustainability bonds

Green and Social Bonds play a key role in the effort to fund projects that provide environmental benefits or support positive social developments. Green Bonds are debt instruments that allow investors to invest in sustainable projects while offering issuers affordable funding to finance these projects.

The proceeds raised through the issuance of Green Bonds are used exclusively for projects that have a positive impact on the environment.

Learn more

-

Green Bonds

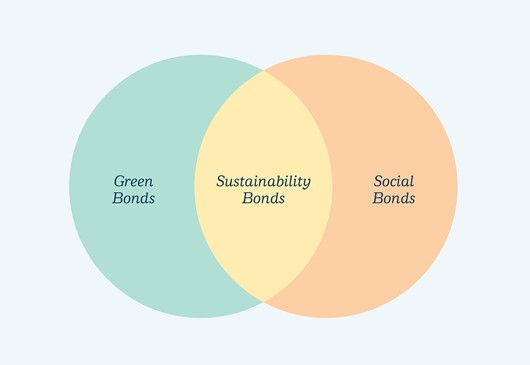

Green bonds are bonds that exclusively finance projects providing clear environmental benefitSocial Bonds

Social bonds are bonds that exclusively finance projects creating positive social impact for one or more target populations, such as excluded or marginalised populations, unemployed, undereducated, etc.Sustainability bonds

Sustainability bonds are bonds that mix financing for both green and social projects.

-

The financial industry has agreed on standards that define which projects are considered “green”. Through its Green Bond Principles, the International Capital Markets Association (ICMA) has created voluntary process guidelines for Green Bond issuers. Projects funded through Green Bonds can belong to various categories, including renewable energy, pollution prevention and energy efficiency.

Verification of the use of proceeds and its environmental impact by specialised independent parties such as CICERO, oekom or Sustainalytics is often used to provide additional comfort to investors in Green Bonds. Regular reporting by the issuer about the projects funded through the issuance of Green Bonds allows the investor to track the environmental impact of the investment.

-

Danske Bank launched its green bond framework in March 2019. In 2022 the framework was relaunched as a green finance framework.

-

See examples of how we have helped our clients issue green bonds here.

Green loans

Green loans are debt instruments that target initiatives with a clear environmental impact. The proceeds are raised through the issuance of green bonds, which implies that these two debt instruments are closely linked. The use of each loan is carefully examined and evaluated by a group of specialists.Danske Bank–labelled green loans are aligned with Danske Bank Green Finance Framework and its green categories which promote the transition to low-carbon, climate resilient and sustainable economies.

-

Danske Bank launched its green bond framework in March 2019. In 2022 the framework was relaunched as a green finance framework.

Sustainability-linked loans

Sustainability-linked loans are an effective incentive to align financing with the borrower’s strategical sustainability objectives. This is done by tying the debt costs to the company’s sustainability performance. The loan margin is depending on the borrower’s achievement of pre-set sustainability objectives: an improvement in the sustainability performance of the company implies lower rates while missing the target leads to slight increase in the costs.

Unlike green loans that are earmarked for specific green projects, sustainability-linked loans are used for financing general corporate purposes. This enables companies from a variety of sectors to receive sustainable financing and simultaneously encourages borrowers to upgrade their sustainability agenda.