The first quarter of 2019 offered several green milestones in Danske Bank. Find five highlights below.

1. Danske Bank became the highest ranked Nordic bank for green bonds

In Q1 2019, Danske Bank were ranked number 9 in Bloomberg’s Global Green Bond League Table, and is thus the highest ranked Nordic bank for Green Bonds.

“This year has seen a strong growth in the green bond market, and we are very proud to be among the banks globally leading this growth and enabling the transition to a greener economy,” says Lars Mac Key, Head of DCM Sustainable Bonds in Danske Bank.

2. Green bond issuance broke records with a booming EUR market

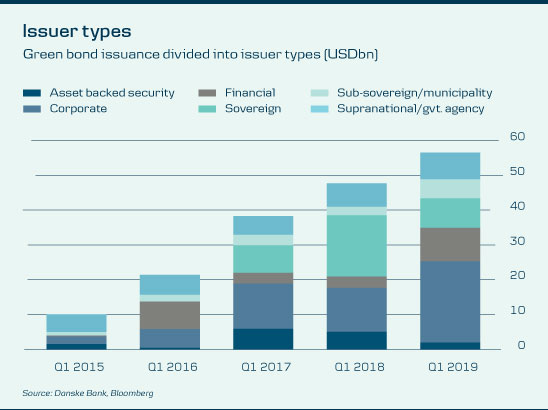

In Q1, global green bond issuance set new records: Green bond issuance increased with 18% from USD45bn in Q1 2018 to USD53bn in Q1 2019. The EUR and the SEK green bond markets in particular stood out with a 70% and 75% increase, and they together account for more than half of all green bond issuance in Q1 2019.

For the EUR issuances, corporate issuers (EUR8bn) contributed the most to the growth, with both repeat issuer and newcomers, but financial institutions also had a great Q1 (EUR4.7bn, up from 1.6bn) with inaugural green bond issuance from e.g. Danske Bank, OP Finance, Leaseplan and Citigroup, and repeat issuers like BNP, ING and Credit Agricole. France, Belgium and Poland together issued EUR6.4bn as Sovereigns repeat issuers, while the Netherlands announced its green bond debut in May 2019.

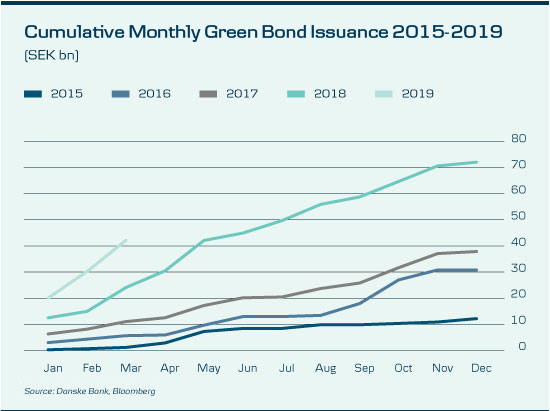

3. The green currents are still forceful in Sweden

The SEK green bond issuance amounted to SEK 42.2bn in Q1, with almost half of the amount issued in January alone. The SEK 42.2bn is a 75% increase of the 2018 record Q1 issuance – and already more than full year 2017 green bond issuance of SEK 38bn. In Q1 2019 18% of all SEK bonds were green.

Issuance highlights include SCBC, who issued the first ever green covered bond (6bn) in SEK backed by mortgage and real estate loans. DNB Boligkreditt issued a SEK3bn green covered bond only one day after, and this bond was increased by another SEK5.5bn in March, making the SEK8.5bn green bond the largest ever green bond in SEK. Danske Bank were joint lead manager on both. Corporates issued SEK17.4bn - almost a doubling from Q1 2018’s SEK 9.3bn. Repeat issuers like Vasakronan, Klövern and Willhem issued the amount of last year’s Q1, while inaugural issuers like Stora Enso, Nobina, Samhällsbyggnadsbolaget i Norden and Electrolux accounted for the increased volume.

4. Danske Bank launched green bond framework for all its entities

In March, Danske Bank group announced its new framework for the issuance of green loans and bonds. The framework enables all entities in the group (Danske Bank, Realkredit Danmark, Danske Hypotek and Danske Mortgage Bank) to issue green bonds. Danske Bank group wants to increase its share of green loans and bond issues considerably over the coming years, to make financing new investments in climate-friendly buildings and technologies easier, and offer loans that will encourage businesses to adopt a more green profile.

“The new framework forms part of our long-term strategy to support societies to transform to net zero carbon economies by providing green financing. We expect investors to be interested in channeling financing via green bonds, including the green mortgage bond, to lending which have environmental positives,” says Samu Slotte, Head of Sustainable Finance in Danske Bank.

5. Danske Bank issued a green bond

On the back of the new framework, Danske Bank successfully issued an inaugural EUR 500m 5-year green bond. Net proceeds of the EUR 500m green bond will be used to finance a portfolio of loans within green activities that promote the transition to low-carbon, climate resilient and sustainable economies, e.g. green buildings and renewable energy in the form of Nordic hydro power plants and offshore and onshore wind farms. The inaugural green bond issuance was very well received by investors, and based on solid demand, Danske Bank managed to issue the EUR 500m 5-year bond with a final order book of 3.3bn at final price.

Additionally, Realkredit Danmark, Danske Bank’s mortgage finance subsidiary, launched their first green mortgage bond to the Danish market, aimed at commercial customers who have a green profile and who seek financing of climate-friendly properties, expected to be properties with an A or a B building energy rating.