Last week, I had the pleasure of presenting my thoughts on climate risk in the Nordic real estate sector to a group of Norwegian institutional investors. I chose to approach the topic based on the definitions set out in Task Force on Climate-related Financial Disclosures (TCFD), who operates with the categories of physical or transition risk.

What is physical and transitional risk?

Physical risk covers the material effects of climate change. The magnitude of this risk depends on how efficiently and fast our societies are able to decarbonise and adapt to a changing climate, but we will inevitable see an increase in temperature, and the changing climate will pose a risk to real estate investors.

Transition risk – and opportunities – is what emerge on the back of policy decisions and market trends that arise from the decarbonisation of our societies.

Risk #1: Global warming increases the risk of flooding

A main physical risk is the risk of flooding: A warming climate will lead to a rise in sea level due to the melting of sea ice and thermal expansion (warmer water takes up a larger volume than cold water).

For Denmark, the west coast of Sweden, and Norway, a rising sea level will increase coastal flood risk, which could lead to damages on properties in coastal regions. The risk of course differs based on geography: In the northern parts of the Baltic Sea, the sea level rise is compensated by land elevation, why coastal floods are less likely in those areas.

Climate change will also result in increased precipitation. Scientists expect that if no action to mitigate climate change is taken, the annual average rainfall in the Nordic countries could increase by up to 30 per cent by the end of the century. The increased rainfall will not be conveniently spread throughout the year, but increasingly result in pour downs in intensive bursts. This increases the risk of surface water - or run-off water - flooding.

What to do as an investor?

- As an investor, make sure to understand, whether your properties are in areas with high surface water flood risk, and what your insurance policy covers in the case of a flood damage. Often the insurance covers only damages caused by “exceptional” rainfall, and not ”ordinary” rainfall. These rainfall definitions can change with a changing climate, so it’s important to keep an eye on them.

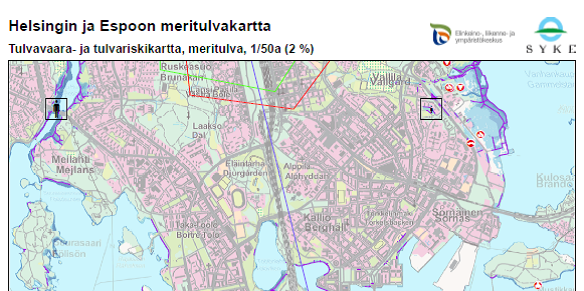

- Consider monitoring physical flood risks: An easy way to do it is to overlay the property portfolio on a flood hazard map by using a GIS program. Investors should use national flood hazard map data sets, which are publicly available in e.g. Norway (nvo.no), Finland (syke.fi), Sweden (gisapp.msb.se), and Denmark (miljoegis.mim.dk). The GIS can also calculate which properties in the portfolio are in a flood hazard area, or close to one.

Example of sea flood hazard map for Helsinki, showing a 2% probability of a flood, or once every 50 years. Risk areas are denoted in purple. Source: Jaakonaho et.al, 2015, Helsingin ja Espoon rannikkoalueen tulvariskien hallintasuunnitelma, Uudenmaan Ely-keskus.

Risk #2: We need more energy-efficient buildings

A main transition risk comes from the energy consumptions of buildings, as these are responsible for approximately 40 per cent of energy consumption in the EU. This means that if we can make buildings more energy-efficient, the overall need for energy decreases incl. the fossil-fuelled energy production.

The EU has a target that the entire building stock in the union should be decarbonised by 2050. This entails stricter energy-efficiency requirements for new buildings, but also a need for significant energy efficiency improvements in existing buildings. These energy efficiency renovations require investments.

What to do as an investor?

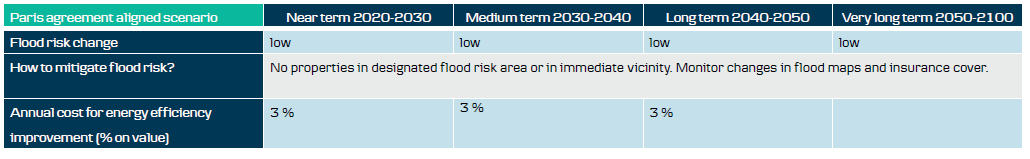

- It requires an estimate of the annual cost for energy-efficiency renovations to quantify the additional cost for this key transition risk. Of course, the risk can vary between investors depending on the current energy-efficiency of the portfolio.

- A simplified approach could be to assume a flat additional energy-efficiency renovation rate for the entire portfolio. The EU Commission estimates that on an EU level, the annual additional renovation rate to achieve a decarbonised building stock in the union by 2050 is 3% per year. The 3% could be used in a Paris Agreement aligned transition risk-scenario, as an annual additional cost from now until 2050.

Measure risk under at least two scenarios

In my opinion, investors are off to a very good start in their analysis, if they measure flood risk as the key physical risk, and energy efficiency improvement cost as the main transition risk. But obviously, there are several other factors that could (and should) be included in a full TCFD aligned real estate portfolio analysis.

Furthermore, all risks should be quantified for at least two scenarios: a Paris agreement aligned transition scenario, as well as a “business as usual” scenario, where no or very little actions are taken to mitigate climate change. The table below summarises the key parameters for a simple TCFD inspired analysis of a real estate portfolio under a Paris agreement aligned scenario and different time horizons.